this post was submitted on 14 Jun 2024

1442 points (99.2% liked)

Political Memes

5507 readers

2483 users here now

Welcome to politcal memes!

These are our rules:

Be civil

Jokes are okay, but don’t intentionally harass or disturb any member of our community. Sexism, racism and bigotry are not allowed. Good faith argumentation only. No posts discouraging people to vote or shaming people for voting.

No misinformation

Don’t post any intentional misinformation. When asked by mods, provide sources for any claims you make.

Posts should be memes

Random pictures do not qualify as memes. Relevance to politics is required.

No bots, spam or self-promotion

Follow instance rules, ask for your bot to be allowed on this community.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

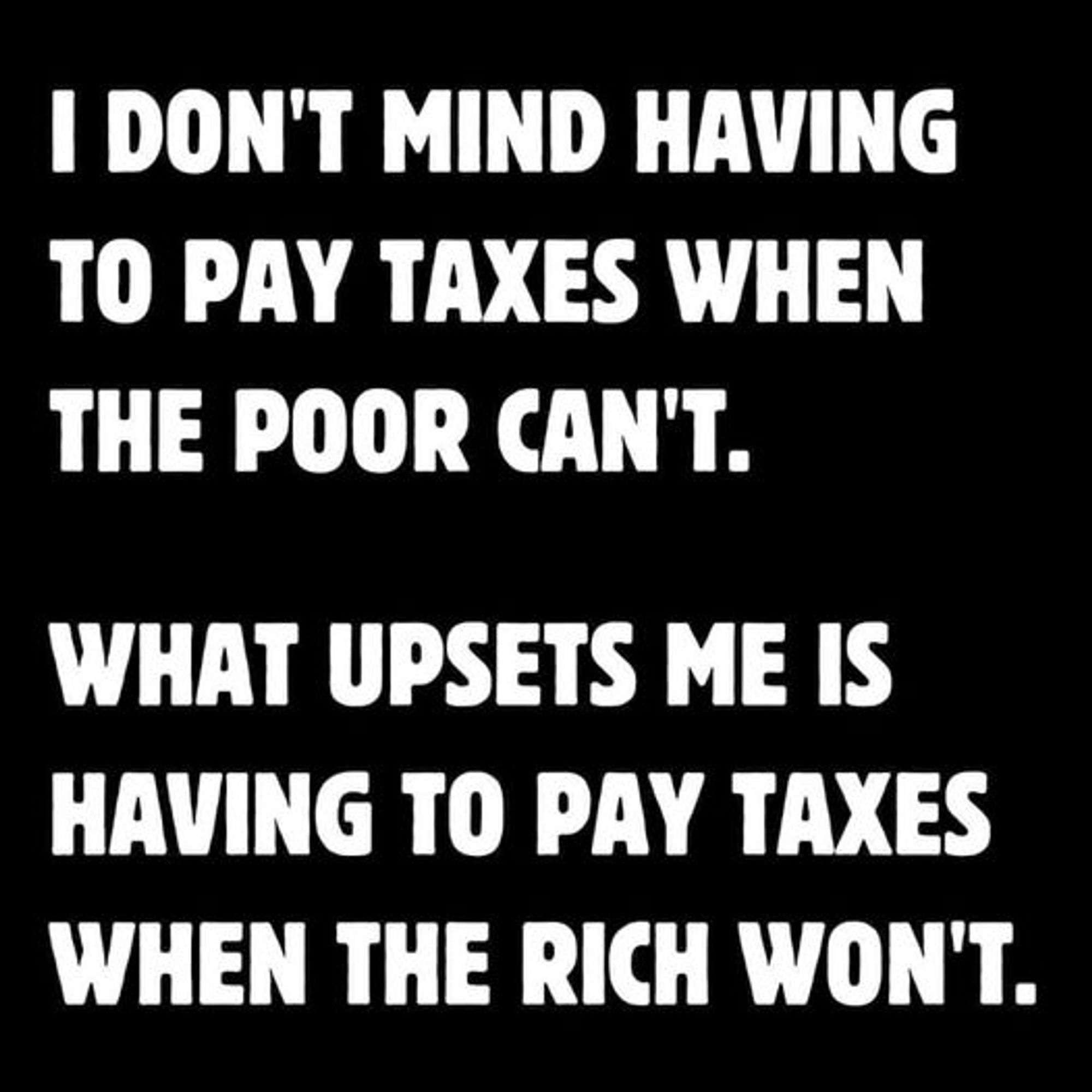

I've posted this before and next time it comes up I'll probably post it again,

Way it should be in my eyes,

Set the brackets at calculated thresholds for the 20th percentile, 40th percentile, 60th percentile, 80th percentile, 95th percentile, and 99th percentiles of incomes.

And just to turn the dial up even more, find the median income in the 20% bracket, and apply just the teensiest percent multiplier to the nominal rate for every time someone's income tips over another twenty times that median

Doesn't just keep tax rates dynamic to reflect the economy, it also ramps up the pressure extremely quickly against wealth accumulation, and suddenly inclines the rich to start eating each other, because now they're all in direct competition to have the most while cutting each other all down to avoid their tax rates spiking, and since it's a flat multiplier instead of a more complex formula, those 99 percenters can get titanically screwed by actually losing money for getting too much, since anything above a third of the nation's wealth means they're paying a dollar and change for every dollar they make. They'll become each other's worst enemies since anyone who starts hording raises the tax pressure on everyone else.

Oh and just to make sure it stays that way, anyone who peaks the 99% club, you are officially acknowledged as "doing well and good enough", and are barred from public office for the next ten years following the last time you pay in that bracket. Just picture it, a government with no one percenters in it, and instead of trying to lobby their way back in they're all too busy trying to tear each other down for a decimal point off their nominal rate.

Got dang this sounds hot hot hot

Quick i need a republican to tell me how this hurts the children or stifles muh innovations or something

Nine

Eleven

thunderous applause from the sticks as the rubes vote to hamstring themselves

If those hijackers were Christians those redcap jackasses would have been cheering, and not enough time is spent making them publicly accountable for that

The main problem is it can't be trivially based on income. You have to figure out how to tax things like stock and "I got a low interest loan from the bank". Things that aren't a check your employer sends you every two weeks.

Probably taxing unrealized gains would do it? If you own stock that's worth a shit load of money, you pay something.

I think people also use stock as a collateral to get loans. That should probably not be a thing you can do to avoid taxes.

Also there probably shouldn't be a marriage tax break. I'm pretty sure that came from some rich asshole who didn't want to pay taxes, so he said half his income was his stay at home wife's to lower his burden. There's a book "the whiteness of wealth" that talks about this, and how it tends to help white people more than anyone else.

See I've got an idea for that too, tax loans collateralized on capital assets (save primary home mortgages, primary vehicle car loans, and other loans of that like) either as income always or if they're given an interest rate below the federal interest rate.

As for marriage tax breaks, I actually disagree, with a caveat, I think what should be done there is to reform the legal concept of a marriage to become the formation of a legal household that provides the legal benefits of a marriage currently but that also fits family models that don't work with traditional nuclear families. Of course laws banning discrimination should remain so that churches won't try to use this as an excuse to say they get to decide who's allowed to be married or not again, but a legal concept that can accommodate something like a three parental figure household would go a long way towards uncomplicating family rights, and also allow cases like cult survivors to band together as next of kin to prevent situations where the legal family tries to kidnap an escapee out of a hospital (saw it in a reddit story)

I think you can change stuff around the legal definition of marriage and family separately from the tax break part. I'm not an expert, but if you're interested in this sort of thing I recommend "The Whiteness of Wealth": https://www.penguinrandomhouse.com/books/591671/the-whiteness-of-wealth-by-dorothy-a-brown/

From another article about it: https://www.wbur.org/hereandnow/2021/05/17/us-taxes-dorothy-brown

So. When you running for president? you've got my vote lmao

Well I'm 27 and have never even held appointed office, so....know a campaign agent who's willing to work on contingency for 8 years at a minimum?

The taxes should be an exponential function of the income, no tax brackets

I never understood why it isn't like that

At least a quadratic or cubic function

I just want to say implementing a mathematical function is far more convenient then using brackets. That way you can make sure anybody who gets a raise also gets to keep more, but pays more taxes at the same time. Because you will never jump a bracket which reduces your income because of higher taxes. The other benefit is, that you can easily implement a negative income tax. This would make sure that anybody who is working, has more income than people who don't work. This would be an incentive for anybody to work what they can, even if it is very little.

Thats not how the tax brackets work. Only the amount that is in that bracket is taxed at that rate. What can happen is a loss of income based social services and tax breaks for lower income families.

You are obviously right. I always mix this up (see Bracket creep why I mix this up). But otherwise my point still stands. In this stackexchange is a graph with an example how tax brackets turn out at each income. My actual point ist, that the graph is not smooth and I don't like that. Also there is a highest bracket, which will allows the super rich to keem growing their wealth. The fact, that super rich people are hiding their actual wealth for example via credits, is a separate issue, which obviously can't be tackled by income tax alone.

Fair yeah, the system needs reform

Dude, what are you even talking about?? The entire purpose for brackets to even exist is to make it literally impossible for this to happen. Maybe take the time to learn how the tax system works before attempting to improve it?!?

Technically the bracket system fits the definition of a mathematical function but taking your intent, I think a single function is actually less flexible, by introducing brackets you can specifically raise or lower the tax burden on demographics that have been shown, at least in America, to form meaningful statistical cohorts.

Plus the wealth percent based rate creates a direct negative impact to wealth accumulation, meaning that rich folks will likely be trying to offload wealth to keep their rates down, meaning that wealth can go back into the moving economy, meaning into the hands of the people it has been horded from through wage theft and price gouging.