Lemmy Shitpost

Welcome to Lemmy Shitpost. Here you can shitpost to your hearts content.

Anything and everything goes. Memes, Jokes, Vents and Banter. Though we still have to comply with lemmy.world instance rules. So behave!

Rules:

1. Be Respectful

Refrain from using harmful language pertaining to a protected characteristic: e.g. race, gender, sexuality, disability or religion.

Refrain from being argumentative when responding or commenting to posts/replies. Personal attacks are not welcome here.

...

2. No Illegal Content

Content that violates the law. Any post/comment found to be in breach of common law will be removed and given to the authorities if required.

That means:

-No promoting violence/threats against any individuals

-No CSA content or Revenge Porn

-No sharing private/personal information (Doxxing)

...

3. No Spam

Posting the same post, no matter the intent is against the rules.

-If you have posted content, please refrain from re-posting said content within this community.

-Do not spam posts with intent to harass, annoy, bully, advertise, scam or harm this community.

-No posting Scams/Advertisements/Phishing Links/IP Grabbers

-No Bots, Bots will be banned from the community.

...

4. No Porn/Explicit

Content

-Do not post explicit content. Lemmy.World is not the instance for NSFW content.

-Do not post Gore or Shock Content.

...

5. No Enciting Harassment,

Brigading, Doxxing or Witch Hunts

-Do not Brigade other Communities

-No calls to action against other communities/users within Lemmy or outside of Lemmy.

-No Witch Hunts against users/communities.

-No content that harasses members within or outside of the community.

...

6. NSFW should be behind NSFW tags.

-Content that is NSFW should be behind NSFW tags.

-Content that might be distressing should be kept behind NSFW tags.

...

If you see content that is a breach of the rules, please flag and report the comment and a moderator will take action where they can.

Also check out:

Partnered Communities:

1.Memes

10.LinuxMemes (Linux themed memes)

Reach out to

All communities included on the sidebar are to be made in compliance with the instance rules. Striker

view the rest of the comments

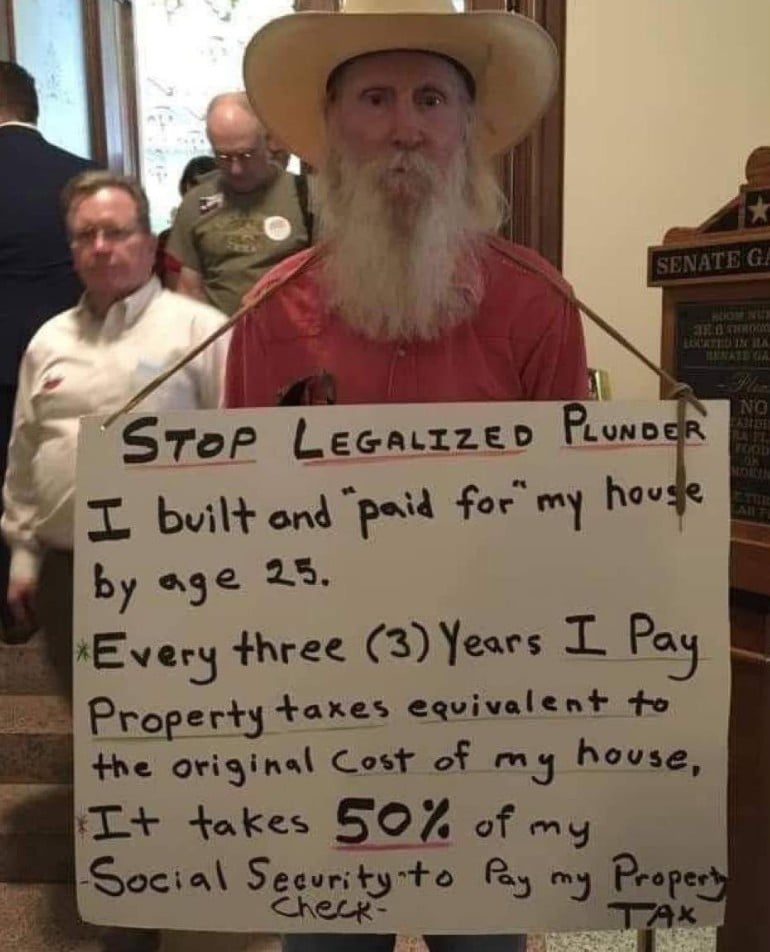

How big is his house? How much is it worth now?

How much did he pay for the land it sits on? Or did he inherit that?

Who does he think maintains road networks and all the other infrastructure he relies on?

Property taxes are based on the assessed value of the land. So if you bought vacant land in the 1970s, improved it with a home, and then lived in it for the next 50 years, you'd see a piece of land that sold for several thousand dollars accrue to hundreds of thousands of dollars. If this guy is living in Texas, he's likely paying 1-2% of the assessed value of the home, which could easily be north of $2-4k/year. That's on land that was practically being given away half a century earlier.

The tax rate is fully disconnected from the cost of construction/maintenance. So if my house accrues from $50k to $200k over the course of ten years, I don't see 4x as much construction/maintenance of my local infrastructure. I just see my tax bill go up 4x while my potholes continue to go unfilled, my lines unburied, and my flood control underdeveloped.

And that's setting aside the habit of municipal governments to invest in "improvements" (sports stadiums, convention centers, police surveillance that's focused around corporate properties, twelve lane highways that induce demand rather than improve traffick flow) that benefit private industry over public welfare. City and state officials serving larger and larger constituencies routinely become disconnected from lay voters and increasingly complicit in graft and other kickbacks, as elections revolve more around partisan affiliation than any actual domestic management agenda.

There is a very real and meaningful disconnect between what politicians do at the municipal/state level and what residents actually demand at the retail level. If this guy was perched in a penthouse overlooking Cowboy's stadium, you could reasonably tell him to fuck off. But I guarantee he's not.

He's likely towing the Libertarian party line. We'd be fine without these taxes and all that government waste.

When you start asking about public services, they start, slowly, carefully re-inventing taxes while downplaying corporate greed while putting themselves in a decision-making role where they get to decide what is right for everyone else.

I'm sure he can hardly afford to live in his ancestral home. That SS he paid into all those years doesn't hit the same as a paycheck and might stop altogether soon. If you don't squirrel away your own retirement, you have to make concessions.

While these are fair questions, I think it's a reasonable stance to take that you shouldn't literally get taxed out of your home if you come into poverty, which unfortunately can include Social Security recipients. I know we all need to pay taxes and contribute to society to the extent that we're reasonably able to, but I'm not so sure this is the best way to make it happen. For property beyond your primary residence, sure, but for your only home, I don't super like it.

If your home is now worth millions, you're now rich and can afford the taxes. If you have no income, sell the house. If you want to live in it, do a reverse mortgage. If you want to pass on your house to your heirs, creating generational wealth while not paying your share of taxes now, fuck you, pay up.

Assuming the house is worth millions is a faulty premise. Housing prices have exploded in the last 5-10 years, and that can mean that a home bought decades ago is worth many times its original value, causing a huge increase in property taxes, but still being in line with other regular homes. People who bought decades ago might have had the home appreciate to 10x the value of initial purchase, just to end up still in line with median home prices. Selling their house won't fix the tax rate, it'll just add some leftover mortgage value after they pay taxes on the profit from selling their massively value-inflated home. So now, instead of just paying property taxes, they pay comparable property taxes and the remainder of a new mortgage.

I can agree on inheritance taxes, but I don't think it's super fair to heavily tax the owner a primary home of a reasonable value when they're not selling the home, giving it away, allocating it through inheritance, or otherwise transferring it. Maybe if it's a mansion, but a simple, normal home, maybe on some farm land? I don't see a problem with a family having the security of knowing that come hell or high water, they have a home they won't lose to anything but a natural disaster. We all need to contribute to society as it contributes to us, but I don't think that should come at the expense of security in basic essentials like housing.

Like I said, do a reverse mortgage. You shouldn't get to lock in minuscule tax rates forever.

And I just don't agree with that. I don't think we should have to pay property taxes at all on a reasonably priced primary residence, as set by local and national standards. Housing should be considered more of a right. We all need to contribute to taxes, yes, no dispute there, but I don't see this as a fair way to do so. Now, if it's an extra property or a particularly lavish home, yeah, tax the piss out of them. But taxing someone into homelessness should never happen because one of the state's core goals at least should be seeing that everyone's basic needs are met, and that includes housing.

I agree it's reasonable for housing to be a right, but I disagree that home ownership should be a right.

Okay, but how do you intend to accomplish that without costing the government more tax money? The most cost effective first step seems to me to be to just not tax a reasonable primary residence. Providing housing the inhabitants don't own costs someone money in building and maintaining that property, and since we're agreeing that housing should be a right, the only way I can see to guarantee that would be through government funding. And we probably should do that for some people, at least those most in need, but what's the sense in forcing people in poverty out of their home of decades just because they can't afford the property taxes, especially when that means pushing them into housing the government is actively paying for? Why is it that we can agree that everyone deserves housing, but we can't agree that they should be able to own that housing? There are other ways to raise that tax money, and the obvious choice is to increase taxes on those with a gross excess, not those who have managed to achieve stability after decades of work.

It is mathematically impossible for someone in poverty to be unable to afford property taxes, because if their property valuation is so high that taxes are a burden, they're not poor. They can sell and pay rent in a more modest place. And yes, if the housing market happens to be whackadoodle and despite the sale proceeds they still can't afford rent for some reason, then they'd be eligible for subsidies.

Including people whose homes, through no hard work of their own, have ballooned to incredible value.

A person who becomes a millionaire through property value increase is even less deserving of tax breaks than a business owner who makes a million dollars. At least the business owner probably put some work into earning the money.

For someone on Social Security, that home may be the only asset of any real worth they have. Social Security pays out an average of less than $2,000 a month. We can squabble over the technical definition of poverty, but look at the reality of it. A 70+ year old person on Social Security doesn't have good odds of getting hired anywhere that's gonna pay him worth a shit. They can't afford modern rent prices on that sort of check. Their only real shot at staying housed without a bunch of other retired and poverty stricken roommates is to have already paid off a home. Their financial situation is very likely to never significantly improve again for the rest of their lives.

Now, I'll admit some states have very low property taxes that won't impact things too heavily, but that's not universally true. Look at New Jersey. They have a property tax rate of 1.86%. For that to constitute half of the average Social Security check, as mentioned in OP, that'd only require a home with a value of $640k, which sounds like a whole lot until you realize the median NJ home price is $540k. That could be a fairly run of the mill house that used to be rural and got caught in urban sprawl, spiking the value. That could be a modest home on a very little bit, not a lot, of farmable land. That could be a home in a rundown part of town that got gentrified over the last decades. That could be a few critical companies moving into the area and spiking home demand. That could just be our housing market doing what it's done for the last half a decade and just belligerently raising prices to ludicrous levels.

I don't think that sounds like he's living it up. I think that on a $2,000/month budget, even if his home value excludes him from the technical definition of poverty, he's still gonna fucking feel like he's in poverty, especially if you fuck with his housing.

Why not just leave them there in that case? What's the sense in forcing them out of their home just to push them into a new home that has almost the exact same problem? Now you're paying for subsidies and paying to manage the subsidy program instead of just... Not taxing them. It's counterproductive.

Sure, but you seem to be drastically overestimating what it takes to get there. ALL home prices in America have ballooned to what should be considered incredible value, especially looking at modern build quality.

And this is why I specifically said to cut the tax for reasonable homes. Dude in a McMansion can downsize. Dude in a slightly over average value home, though, can stay put and forego some taxes as far as I'm concerned. Set a threshold, but tie it to local property values. An average home should be fine. I might be willing to agree to double, but I'd have to think and research more. But beyond the value of a reasonable home, sure, levy taxes on the excess. Something like full property taxes on any value over some threshold.

Eh, I think business owners get too much credit. The vast majority of value created by all but the smallest companies is created by the workers. Most business owners depend on exploiting their workers. CEOs sure as HELL aren't working hundreds to thousands of times harder than their lowest paid employees. Someone that's self-employed, sure, busting their ass and earning it, but business owners on the whole, no.

I dunno why you think old people who didn't save enough for retirement should automatically get to live a good life by making the housing market worse for younger people. When you're poor, life sucks, that's how it is.

To free up housing stock and keep liquidity and supply in the housing market. To undo the crystallization we see in the market with old people clutching to their houses with all their might. To reduce the overwhelming cost of purchasing ones first home.

Sometimes, when you can't afford something, you need to sell it and get a cheaper version. When that thing is a house, sometimes you need to move away. I see no reason why old people should be exempt from this.

Bruh they're on less than $2k/month. They aren't living it up. That's $24k/year. That's a $10/hour full time job. That's poverty wages.

There are 28 vacant homes per homeless person in the US. It's not old folks wanting to live in the homes they spent decades in. It's corporate landlords and bad zoning laws.

Only because we let the rich condemn us to it. Productivity is at an all time high. We've basically conquered scarcity. The only real reason to continue allowing poverty is to keep forcing us to serve the owner class.

See above on how this isn't their fault.

But they only can't afford it because of taxes. They literally managed to afford the entire house and all the maintenance on it. They can afford the house until we decided our elderly deserve to live on poverty wages while being taxed on their housing. I've already shown that it doesn't even have to be that nice a house. It could very easily be a mediocre house that used to be rural and just got consumed by urban sprawl. So now, in their old age, you want to force them out of that home, which means they'll probably be forced out of their community, which means they'll lose their support network. Which will really fuck them.

You think the government just takes taxes and burns it? Taxes are required for government to function. Saying "they only can't afford it because of taxes" is as silly as saying "I only can't afford a new car because of how much it costs".

Corporate landlords, while scum, have little to do with the housing crisis. And yes, it is zoning laws, but it's also old people wanting to clutch to homes they shouldn't be able to afford anymore.

If taxes were fair, there would be far more housed people. The old retired people could sell their million dollar home and move out to the crappy shithole with cheap houses and no jobs that you apparently want young working people to somehow live in. AND, the retired people would spend their money THERE and make that place less of a shithole. AND, the increased housing stock would lower prices and help counteract the very problem you're talking about - high taxes due to high home valuations.

Lmfao old people living in their homes is a bigger problem than corporate landlords? That's absolutely ludicrous. And you want to keep harping on these expensive ass houses when I already demonstrated that you can spend half your Social Security on a barely over median value home AND agreed with you that it shouldn't apply to particularly lavish homes. You're not interested in facts. You've found your enemy to hate, and somehow, you chose elderly retired people instead of the moneyed interests routinely fucking us all over. I'd devote the time to explaining why that's wrong and providing evidence, but you've clearly demonstrated that your clown ass will just ignore it.

SPECIFICALLY concerning the abysmal lack of housing, yes. Not generally. Don't twist my words.

And these precious poor old homeowner people you keep defending ARE MILLIONAIRES. Fuck em. They're dragons sitting on their hoards, and the fact that it's a smaller hoard than the corpo fucks does NOT make them our friends or allies or deserving of our pity. Their greed is making things worse for all of us.

So what they want to live in their community? So does Zuckerburg, and we'd be well within our rights to drag him out of his home and onto the street. Taxes are your debt that is owed to the community, and everyone who doesn't want to contribute their fair share, based on the wealth they have, can get fucked. No exceptions just because they're old. Pay your damn taxes.

I literally did the math to prove that isn't always the case. This is why I didn't bother providing more facts, you're just going to prioritize your feelings over hard facts.

And even if a barely over median home value DID make them a millionaire, that's a gross condemnation of the housing market, not a literally barely above average home owner. The idea that someone living in the home they bought and owning no other properties might be responsible for the housing problems is absolutely ludicrous because that's the fucking point of housing. If you think people living in their own homes is the problem with the housing market, I really have no idea how to address the utter void of reasoning required to reach that conclusion.

Yeah, my point still stands. Housing is for people to live in. People living in their own housing will never be the cause of the problem when that's the whole fucking reason we build housing. I really don't understand how you could blame someone living in their only home MORE than you blame corporations who buy homes for the express purpose of renting it out for profit, the literal fucking definition of rent seeking behavior.

I'm not advocating for exceptions for the elderly. You expressly avoided quoting my actual proposal, no taxes on a primary residence of a reasonable value in relation to state home values. That's not saying people shouldn't pay taxes. That's saying that their home shouldn't be a tax burden so long as it's a reasonable property.

When old retired people are able to hold on to houses they shouldn't be able to afford, it lowers the supply of housing in the area, which likely has higher house values because it's an area with jobs, attracting young working people. San Francisco, Seattle, Cincinnati, Austin, hell practically every mid to large city. Lower supply = higher prices. In addition, old homeowners paying lower taxes means a greater tax burden on new homeowners, again meaning higher prices.

The math is inescapable, and no emotional screeching will change that truth. You may not LIKE it, it may not give you the warm fuzzies, but that does not mean it's wrong. Don't call your emotional response "fact". It's wrong.

Prop 13 and its variants are absolutely an exception for the elderly. And their heirs, which is just blatant bullshit, but that's a whole other conversation.

When property values go up, taxes should go up proportionally. If a proportional tax increase means you can't afford your home anymore, then you can't afford your home anymore.

That IS saying people shouldn't pay taxes. Unless you disagree with the entire concept of taxing wealth. A home's value is wealth. You may not want to think of it that way but it's worth money the same way a stock portfolio is worth money. The same way a yacht is worth money. If you believe those assets should be taxed, then a home should be taxed. And I do believe that wealth should be taxed entirely separately from and irrespective of income. The tax RATE should obviously be progressive and not a flat tax. But no blanket exemption, especially not for poor pitiful millionaires, whatever their social security check dollar amount is.

Only because you want to tax them while letting them live on a poverty income. I might see your point if Social Security payouts were substantially increased, but they aren't, and you aren't proposing that we change that, either.

Once again, you completely ignore that under my proposal, those young people wouldn't be paying the property taxes, either. So this is a completely irrelevant point to what I'm proposing.

Now try applying this to rent seeking scalpers, too, not just people trying to live in the homes they bought with their own hard work. How's it impact the housing market when the guy buying up homes doesn't even want to live in them? You think maybe a little more heavily than someone just trying to not be homeless?

That's a really fucking bold claim to make when you're the one who hasn't done any math here and completely fucking ignored my math. I at least actually did my own research and math on tax rates and Social Security to make an informed conclusion that they are NOT all millionaires. You just keep screeching about irrelevant millionaires even when I already said multiple times that exorbitantly valued homes shouldn't be tax exempt.

Yeah, you're 100% right, it is a whole other conversation, one I'm not part of. I haven't mentioned Prop 13 once, nor did I even know what it was. And at a glance now that I'm aware, it's not what I'm fucking advocating for. You wanna try actually addressing the points I'm making instead of just ranting at me about whatever pissed you off?

That sure is a blind logical leap you're making there. Especially when I already agreed to property taxes on high value homes, multiple times. I SPECIFICALLY said no property taxes on homes of a reasonable value, as defined by semi-local values. I say semi-local because living in a particularly town or area shouldn't exclude you from taxes just because your neighbors are rich, too, but I'd be willing to make some locality concessions because of how home values vary by region, probably averaging out to at least some extent with the whole state. Hell, you could also do it as a sort of minimum threshold like we do with tax brackets. Properties valued under $XXX,000 get no tax with XXX dependent on region, anything above that pays full taxes on the value above that threshold, double taxes on value above a secondary threshold, and double it with no minimum threshold if it's not your primary residence.

Ah, yes, because a home providing shelter in line with local averages and basic human needs is definitely the same thing as a luxury item that serves no true need in life. Because we should tax luxury yachts, we should also tax basic necessities like homes? That's the clownest of clown takes.

I think we agree here but disagree on implementation. Personally, I see a wealth tax as a means to prevent wealth consolidation at the top, so I do not see it as reasonable to apply to someone who simply owns their home and has a respectable retirement fund because that's not making a significant contribution to wealth consolidation. I would obviously include an exemption for a primary residence of reasonable value. Extra emphasis on "of reasonable value", because you seem to need a little assistance with your reading comprehension since you've ignored it literally every single time I've said it, which has been many times at this point. I'd probably set the minimum threshold for a wealth tax substantially higher than you, though. Norway, for example, taxes wealth above ~$110k USD, I think it is, and they only consider 1/4 of the value of the home. This may sound like a reasonable starting point until you realize the average home price is around $500k, which means you're already often looking at taxes on an average home. At a first guess with minimal research behind it, I'd say the threshold should probably be 2x-4x as high and with a bigger carve out for homes, again only if they're reasonably valued. I don't think you should start getting hit with a wealth tax the instant you actually start getting ahead.

And at the risk of wasting my time by typing out only to have it ignored yet again, I'm going to reiterate that I'm NOT SAYING THEY SHOULDN'T BE PAYING TAXES. People should generally pay taxes. I just don't think we should be levying taxes on basic human necessities, and even states with a sales tax often acknowledge that to some extent by making basic food items tax exempt. A wealth tax with reasonable exceptions for things like reasonably valued homes and a large savings that still don't make them rich are fine. Income taxes are fine and should be higher at the higher end of the brackets, probably with another new bracket or two on top.

Ok fine I'll address some of the things I've been ignoring.

Because the entire housing market is unreasonable in almost every city in the Western world. It's not just a few outliers here and there that can be compared to some average. The average itself is completely out of whack. We can't just rein in the crazy part of the market; the whole market is crazy. Either we pick a semi-arbitrary value and tax above that (your plan) or we introduce a graduated, progressive tax on all homes (my plan). Introducing exemptions and especially benefit cliffs has historically always had crazy unforeseen negative consequences. A tax on all homes will by itself automatically bring the market closer to equilibrium.

The average home price in San Jose, CA is $1.4 million. That is crazytown. We can't look at that as a benchmark to try and bring prices in line with.

Moreover, I would argue that anyone who owns a home at all is already of enough means that they don't need tax breaks. Proportional to your equity obviously, someone who just closed on a house shouldn't be slapped with a tax bill based on the whole value of that house. But we have a 0% income tax rate on the lowest incomes because that income is essential to living. Home ownership is not essential. Having shelter is essential, which is why I support taxpayer funded grants to homeless people etc, but home ownership is not and should not be a fundamental right. If you can afford to buy a house, you can afford to pay taxes.

Housing policy is already a big enough conversation. Incidentally, I actually support universal basic income, which you could look at as substantially higher social security payments.

But relevant to this conversation, social security in its current form is not a pension. If all you're living on is social security, you probably can't afford to retire. If you're physically unable to work, then that's disability. If you don't have enough money saved up to pay for the life you want, but happen to be age 65, you're not retired. You have to keep working.

Mathematically, it's close enough to what you're advocating for: a tax carve-out for homeowners, incidentally with the same tear-jerking "old people forced out of their homes by evil taxes" argument. It has the same supply-demand effects as well.

So, to summarize:

I'm ignoring your "reasonable price" point because it's either arbitrary or unworkable

I'm ignoring social security because it's not a retirement plan

I'm equating you with prop 13 because the socioeconomic effects are essentially the same

Instead I'm addressing the core of your point, which is that homeowners should not pay taxes on their home (within reason, mansions etc excluded). To which I say, "yes they should, all of em". Again, if you have enough money to buy a house, you have enough money to pay taxes. If your house increases in value such that you can't afford the taxes anymore, fucking congratulations, you just made a bunch of money. Now you get to experience the pain of renters being priced out of their own neighborhoods, but also with a small golden parachute to take with you. And it makes things less bad in general for everyone by helping to bring housing costs down across the board.

Also, just to keep this conversation in perspective, I don't think this is the MAIN reason why housing is crazy in places that have similar tax carve-outs for homeowners. I actually think that's zoning and local NIMBYism. But this definitely contributes a fair amount.