this post was submitted on 06 Nov 2023

55 points (78.4% liked)

Te Wai Pounamu / South Island

247 readers

8 users here now

Kia ora and welcome to the Te Wai Pounamu / South Island community!

A community for Te Wai Pounamu / South Island related conversations.

General rules:

- Try and keep conversation South Island focused

- Stick to the General Lemmy.nz CoC

Credit to @rjd@lemmy.nz for the banner photo!

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

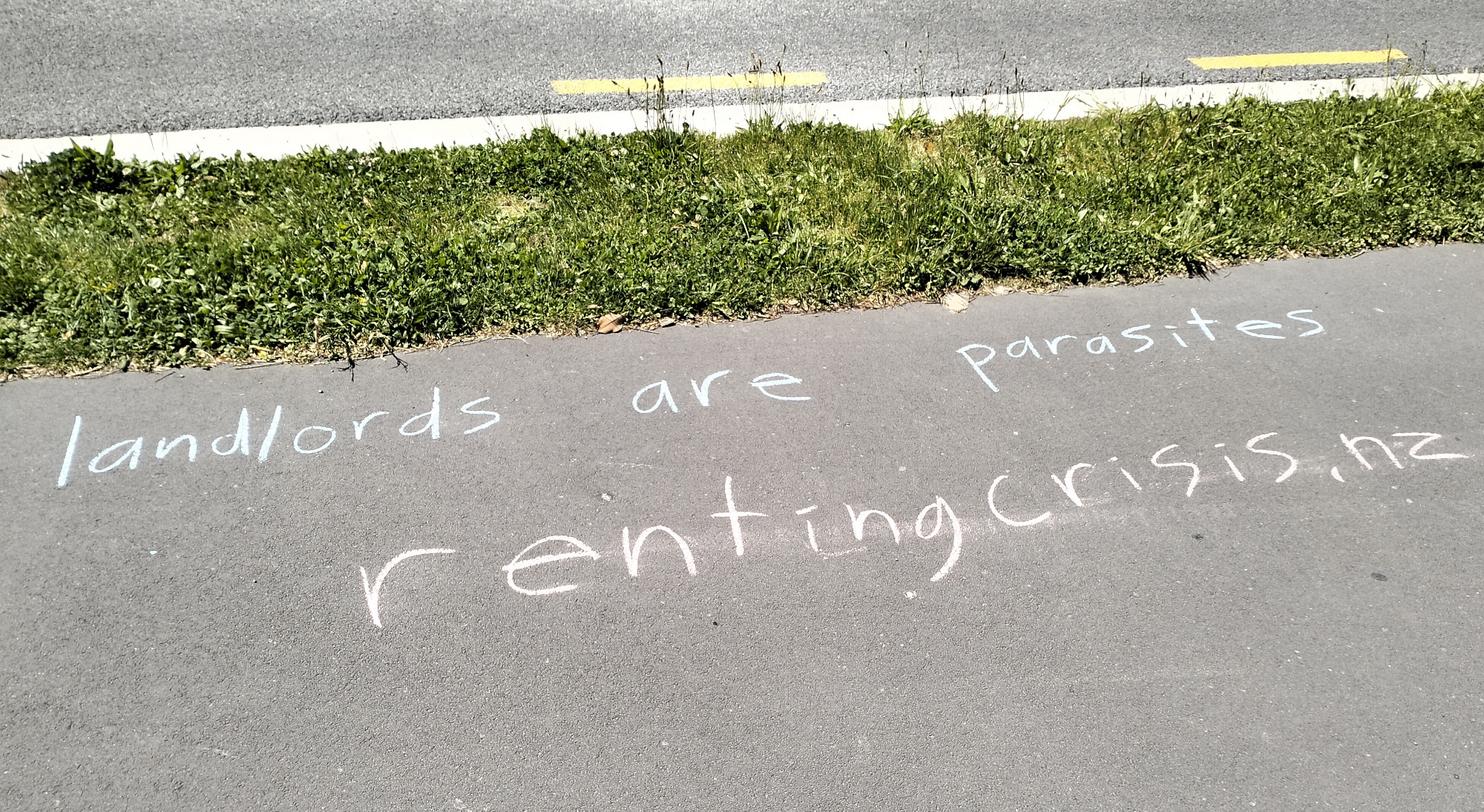

The issue is that a LOT of people have their retirement based off of this system. They've worked their whole lives to achieve what they've seen as a fantastic, almost fundamental, way of providing for yourself in retirement. I don't want to hurt these people, even if they make up a sizable portion of the landlords. They are not the problem.

I'm trying to target the people that own 3+ houses, and if you can eliminate the money-making aspect of homeownership, you fix a big problem causing the housing crisis right now.

It wouldn't say it's a lot. Most rentals are held in portfolios with 3+ properties - the idea that the rental market is mostly 'Mum and dad investors' is a myth.

Nearly half the population rent. That's the bigger retirement crisis, people are spending massive amounts on rent, which has the double whammy of locking people out of affording a house of their own, and impacts their ability to save for retirement.

If we had UBI they wouldn't need the retirement income.

NZ superannuation is a basic income for all above age 65.

Even with UBI, people will always want more money if they are able to get it. UBI unfortunately wouldn't solve this issue. UBI needs to get passed though.