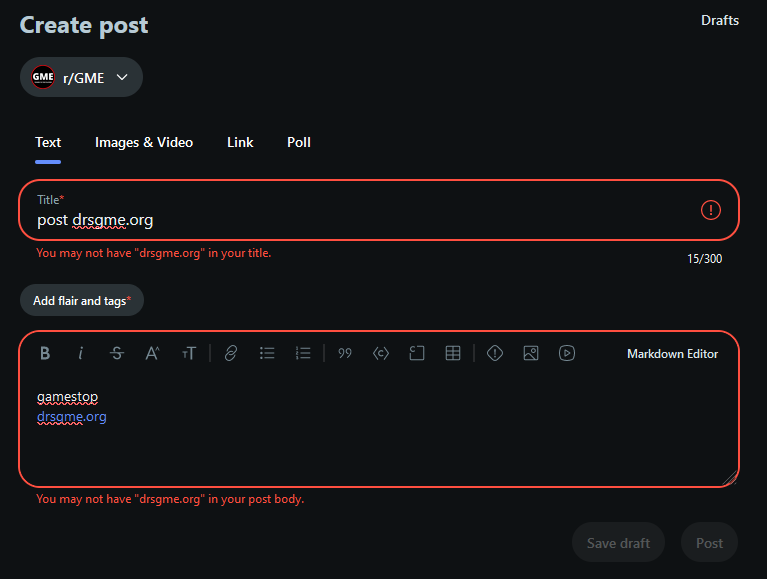

Reddit as a whole continues to demonstrate corrupt acts of information control against the interest of Reddit's users.

Imagine being a shareholder of any company but not allowed to have a voice in shareholder social media communities because the unaccountable moderators / admins of those communities decided that you don't get a voice. how fucked up is that? this is the power that reddit has over shareholders of companies that have nothing to do with Reddit. it's one of the reasons i have reluctantly found myself using X more. X too suffers from problems but not censorship the way reddit does.

i of course would ultimately love to see more users on Lemmy and other fediverse apps, but most people are not really interested in this right now. maybe as the enshittification of reddit gets unbearable, more people will consider Lemmy

🤷

🫡