this post was submitted on 28 Apr 2024

1019 points (90.7% liked)

memes

10297 readers

1685 users here now

Community rules

1. Be civil

No trolling, bigotry or other insulting / annoying behaviour

2. No politics

This is non-politics community. For political memes please go to !politicalmemes@lemmy.world

3. No recent reposts

Check for reposts when posting a meme, you can only repost after 1 month

4. No bots

No bots without the express approval of the mods or the admins

5. No Spam/Ads

No advertisements or spam. This is an instance rule and the only way to live.

Sister communities

- !tenforward@lemmy.world : Star Trek memes, chat and shitposts

- !lemmyshitpost@lemmy.world : Lemmy Shitposts, anything and everything goes.

- !linuxmemes@lemmy.world : Linux themed memes

- !comicstrips@lemmy.world : for those who love comic stories.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

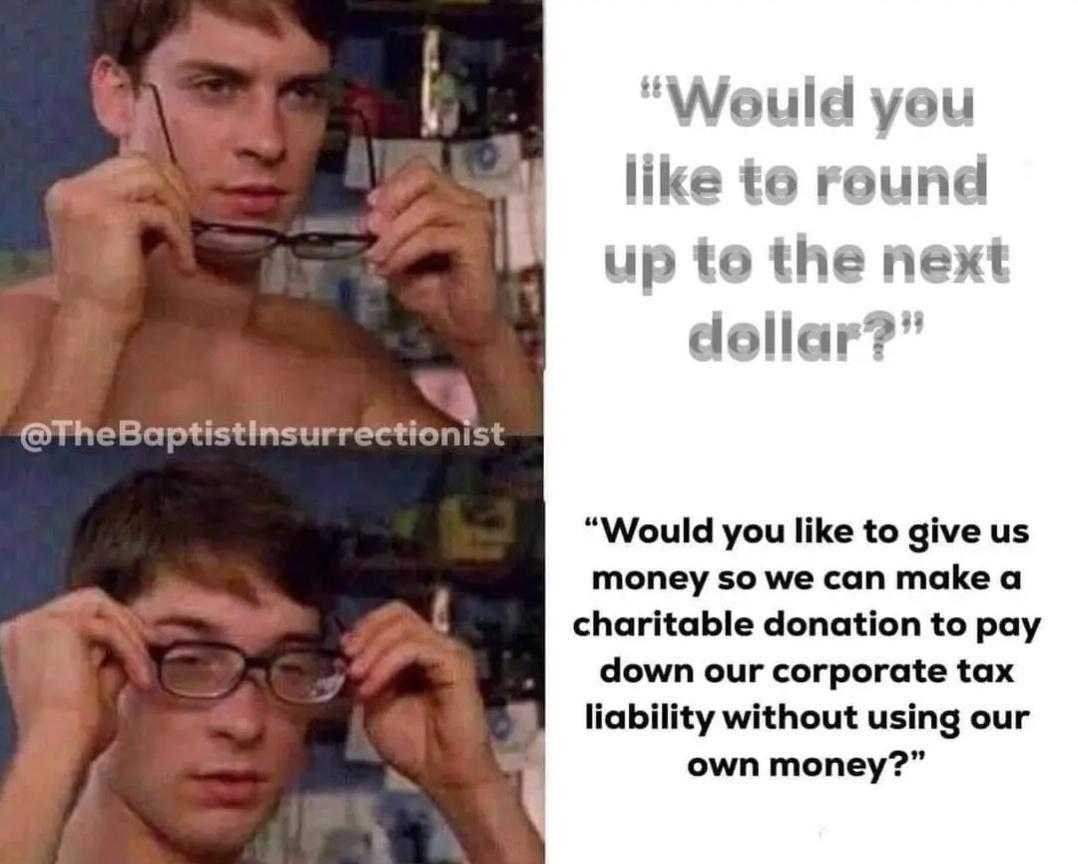

Thats only because of how the standard deduction works; If you have to itemize, then any amount of charitable donations can be deducted (up to like 60% of your AGI i think). Basically anyone needs to "outweigh" the standard deduction with their own deductions, because doing otherwise is worse. Technically i think you could forgo the standard deduction and use your own, even if you don't go over the standard deduction, but why would you?

That's the point: almost nobody benefits from charitable donations because almost everybody takes the standard deduction, so "but you can get tax benefits for donating!" is a red herring in almost all cases.

That catch on current code is that they combined exemption with standard deduction. Makes it quite a bit more difficult than the before times.

I'll leave it at that as I'm generally overwhelmed with unparalleled Internet tax expertise any time the subject arises.