this post was submitted on 07 Mar 2024

961 points (91.0% liked)

General Discussion

12091 readers

4 users here now

Welcome to Lemmy.World General!

This is a community for general discussion where you can get your bearings in the fediverse. Discuss topics & ask questions that don't seem to fit in any other community, or don't have an active community yet.

🪆 About Lemmy World

🧭 Finding Communities

Feel free to ask here or over in: !lemmy411@lemmy.ca!

Also keep an eye on:

- !newcommunities@lemmy.world

- !communitypromo@lemmy.ca

- !new_communities@mander.xyz

- !communityspotlight@lemmy.world

- !wowthislemmyexists@lemmy.ca!

For more involved tools to find communities to join: check out Lemmyverse!

💬 Additional Discussion Focused Communities:

- !actual_discussion@lemmy.ca - Note this is for more serious discussions.

- !casualconversation@lemm.ee - The opposite of the above, for more laidback chat!

- !letstalkaboutgames@feddit.uk - Into video games? Here's a place to discuss them!

- !movies@lemm.ee - Watched a movie and wanna talk to others about it? Here's a place to do so!

- !politicaldiscussion@lemmy.world - Want to talk politics apart from political news? Here's a community for that!

Rules

Remember, Lemmy World rules also apply here.

0. See: Rules for Users.

- No bigotry: including racism, sexism, homophobia, transphobia, or xenophobia.

- Be respectful. Everyone should feel welcome here.

- Be thoughtful and helpful: even with ‘silly’ questions. The world won’t be made better by dismissive comments to others on Lemmy.

- Link posts should include some context/opinion in the body text when the title is unaltered, or be titled to encourage discussion.

- Posts concerning other instances' activity/decisions are better suited to !fediverse@lemmy.world or !lemmydrama@lemmy.world communities.

- No Ads/Spamming.

- No NSFW content.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

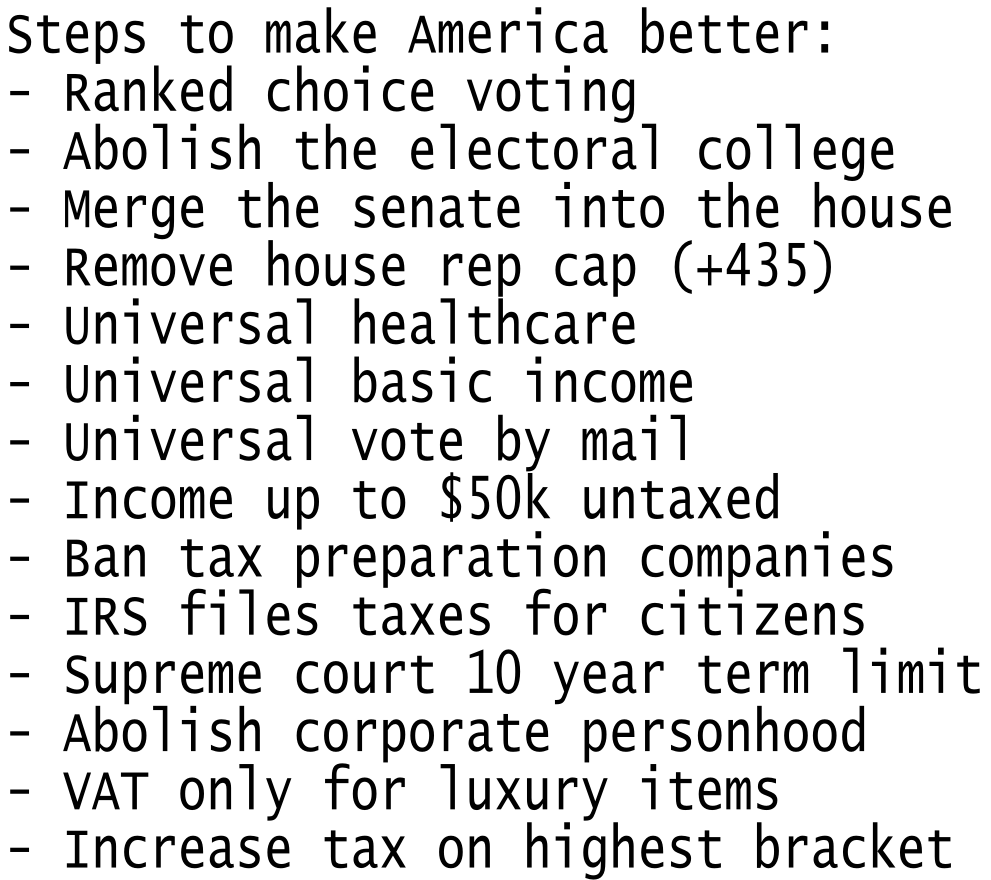

The nonsense is there specifically to benefit the tax prep companies. Getting rid of one without the other isn't... Anything anyone is advocating for. You get rid of both, simultaneously, because you have to, and because it's right. How you make it work? Tax the rich, mostly

We should definitely give most people a better option for filing taxes but can’t imagine being able to get away from that as you get wealthier, have a business or certain non-salary income sources.

Tax prep services will always be necessary, but not for the majority of individuals

But there are very little income sources that the IRS couldn't have direct access to - just build a national system connecting banks, brokers, international transactions, etc. Put the reporting burden on companies and other gov bodies.

These are complex admin systems that wealthy counties build, part of an overall digitalisation of government systems. I mean, I can't think of a single government related thing I can't do online (or on the phone). Every citizen can be issued 2FA once identified (and/or a digital certificate), the rest we pay taxes for them to set up.

IRS has no reliable way of knowing my cash tip income, that I won the Irish lottery, that I sold my vineyard in France for a tidy profit, etc. without an audit, they have no way to follow a shell game of payments criss-crossing among my 500+ companies to be able to tax my real estate profits. They can’t know the depreciation I’m writing off for expensive office furniture is for my summer home

If I understand you correctly - isn't that profit tax? And companies have the burden and obligation to report.

And I was talking about common folk or like 95% of USA. You are right about cash-tips. We just dont pay taxes on it. But it's also not an integral part of, well, anything. Its more of a p2p transaction.

Companies have the burden to report but if you have many you can play games with payments across each other to concentrate the profit or loss to advantage yourself. Depending on how it’s incorporated m, that may belong to the business entity or you. As far as I know, IRS generally treats each business entity separately, so unless they have reason to audit, may not be able to follow a chain of payments across them.

I thought we were talking about income tax, not profit tax. And Im sure IRS has group-level reporting and audits ... at last on paper, pre-lobby/bribes at last.

Afaik everyone needs to file solo & consolidated group level bs and p&l statements.