this post was submitted on 30 Jan 2024

1088 points (98.5% liked)

Technology

72838 readers

3984 users here now

This is a most excellent place for technology news and articles.

Our Rules

- Follow the lemmy.world rules.

- Only tech related news or articles.

- Be excellent to each other!

- Mod approved content bots can post up to 10 articles per day.

- Threads asking for personal tech support may be deleted.

- Politics threads may be removed.

- No memes allowed as posts, OK to post as comments.

- Only approved bots from the list below, this includes using AI responses and summaries. To ask if your bot can be added please contact a mod.

- Check for duplicates before posting, duplicates may be removed

- Accounts 7 days and younger will have their posts automatically removed.

Approved Bots

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

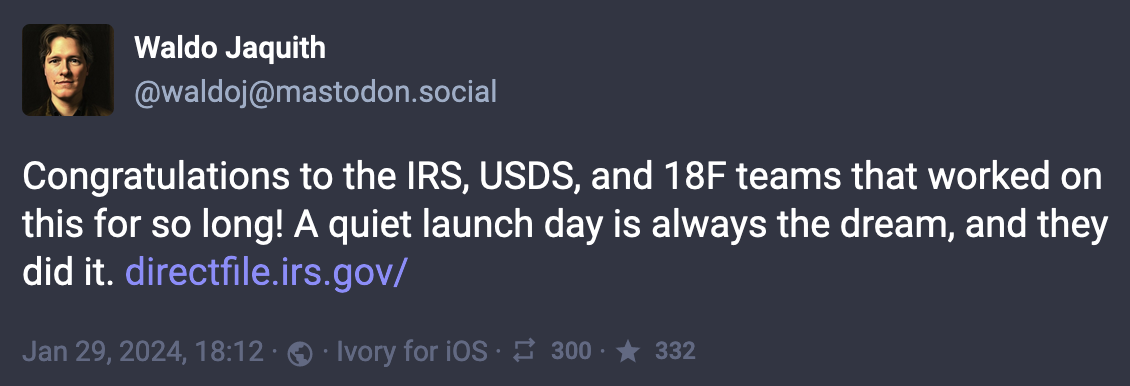

Just a heads up it’s only available for the following states:

Arizona California Florida Massachusetts Nevada New Hampshire New York South Dakota Tennessee Texas Washington state Wyoming

Yeah, bummer. I'll have to wait I guess.

Which is funny considering this is only for federal and not state taxes. Do they say why it’s limited to specific states?

Most of the listed states do not have state level income taxes. The only exceptions are Arizona and California. The rest of the states have no state level income tax. Alaska is the only state without a state level income tax that isn't included in this IRS scheme.

I imagine there is a reason all but two of the chosen states lack a state level income tax.

Massachusetts does. Per the IRS site, the tool won't help file it, but will lead you to another tool that does.

State taxes are probably an additional complication in the calculations that hasn’t been implemented yet for all states. And for those without a state income tax not covered, probably some other state-tax-adjacent thing

It's a trial program, to work out the major kinks, issues, and problems before rolling it out further to other states.

It's also federal-only, meaning you still have to do your state returns. Most of the states in the trial have no state income tax, which makes it an ideal solution for taxpayers in those states.

Expect it to expand to all 50 states in the coming years, presuming Republicans don't somehow manage to legislate it into oblivion like usual.

If they have no state level income tax how do the states get money for things? Do they just tax businesses?

Sales tax, property tax, lottery also

so the most populous states, and somehow, 2 in the bottom 5.

Testing the outliers?

Surprised Texas is in that list.

Yeah, what a bummer that free federal tax returns are only offered to a few states.