this post was submitted on 16 Nov 2024

787 points (98.6% liked)

Microblog Memes

5793 readers

2807 users here now

A place to share screenshots of Microblog posts, whether from Mastodon, tumblr, ~~Twitter~~ X, KBin, Threads or elsewhere.

Created as an evolution of White People Twitter and other tweet-capture subreddits.

Rules:

- Please put at least one word relevant to the post in the post title.

- Be nice.

- No advertising, brand promotion or guerilla marketing.

- Posters are encouraged to link to the toot or tweet etc in the description of posts.

Related communities:

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

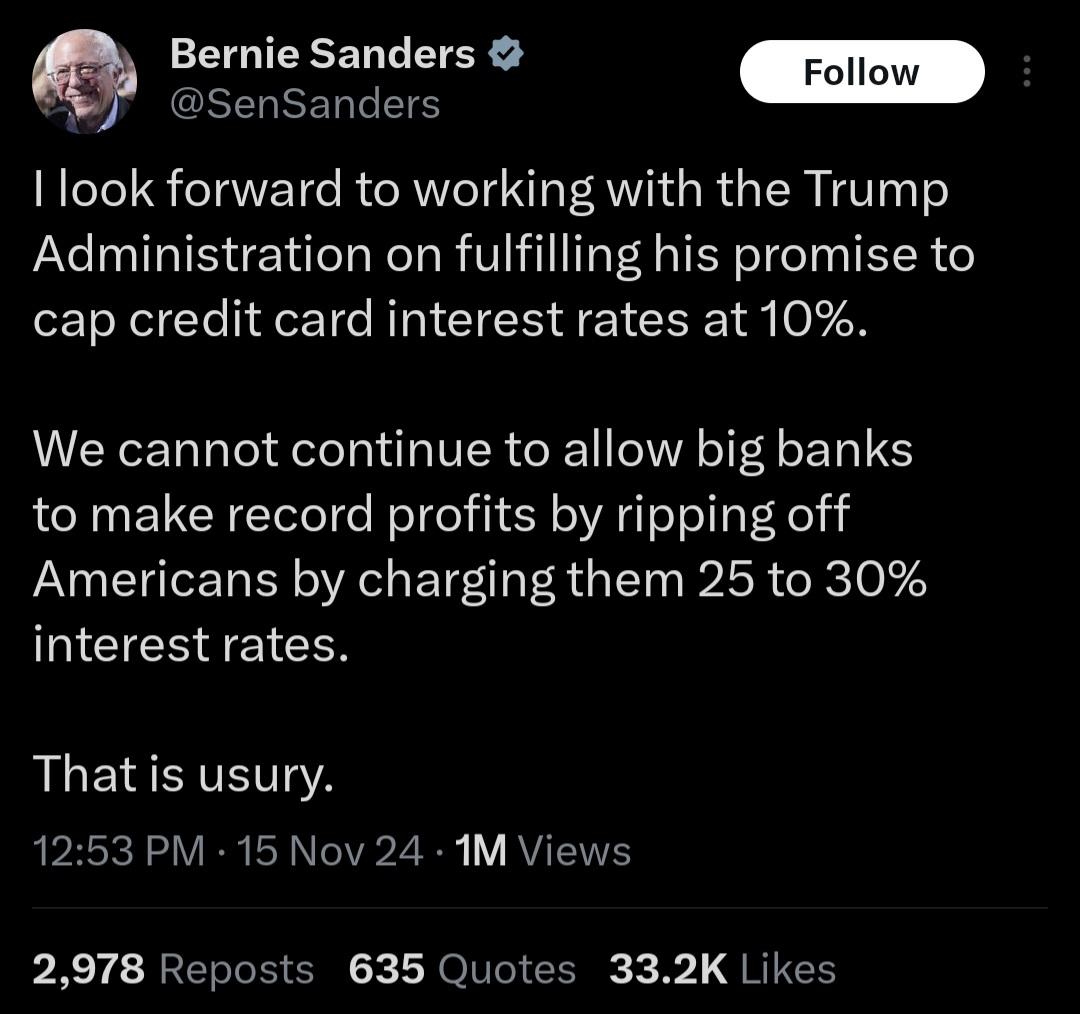

What that would actually mean is a complete lock-out on credit cards for the poor.

Considering how many Americans have crippling credit card debt, especially poor people, would that be worse? I'm sure they'd still offer those credit builder cards with low limits that you have to deposit collateral for the limit.

I'd expect a lot more use of buy now pay later schemes like Klarna.

It's similar to a credit card, but prevents build up of crippling debt.

I personally use my credit card and pay in full each month, not because I need the credit, but because in the UK you get the benefit of Section 75 protection on purchases. I've used that a few times when companies have gone bust. If I'd paid on debit card I'd have been screwed.

Buy now, pay later does not prevent crippling debt. It makes it easy to buy without thinking or realising the actual cost. It makes is easy to stack up invoices that you in the end can't afford.