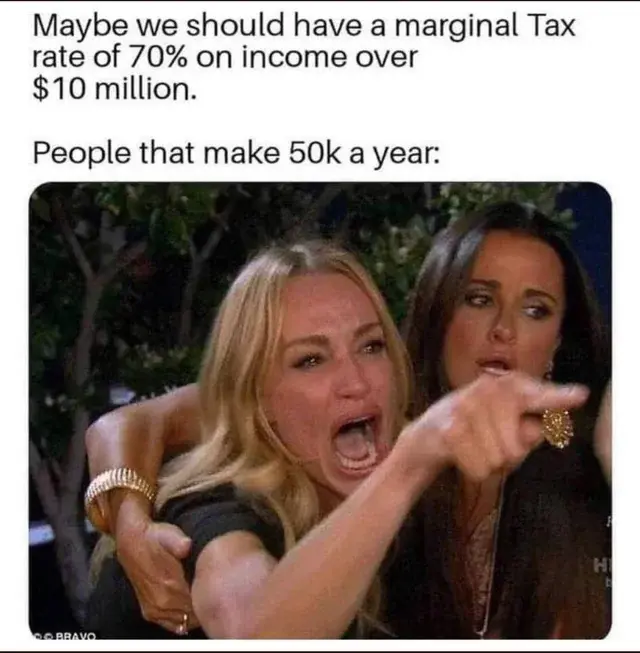

Billionaires make money off stocks and asset gains, so taxing income higher generally only hurts the upper middle class (i.e. doctors, high earning professionals).

In Canada the average effective tax rate actually decreases once you hit like $750k (I don't have exact numbers, it's been a while since I analyzed this one) because those people stop paying as much employment tax and instead pay capital gains which are taxed at 50%.

So, if you're middle class, or upper middle class, you're paying twice as much as the millionaires and billionaires are per additional dollar made.

And that's the best case because the really rich people put their assets under a corporation and continually "reinvest" their gains while harvesting their losses (businesses pay 26.5% tax).

So Rich people pay a marginal rate of 26.5/26.8%, while the upper middle class pay 53.5% on their income.